- 10 Dicembre 2007

- 15,026

- 3,334

Articolo interessante di Aspire Aviation sui WB del futuro.

Delta loss shows availability key to Boeing’s widebody strategy

Airbus has much to celebrate when Qatar Airways eventually takes delivery of its first A350-900 on December 22nd, despite a last-minute delay in the official ceremony over minor issues. Not only did it run a flawless 2,600-hour, 680-sortie flight test programme in record time, resulting in its type certificate being earnt from the European Aviation Safety Agency (EASA) on 30th September, 14.5 months since first flight, Airbus also won a significant order from the third-largest US carrier Delta Air Lines which opted for 25 Airbus A350-900s and 25 re-engined A330-900neos (new engine options).

The first deliveries of the A350-900 and A330-900neo will begin in 2017 second quarter and 2019, respectively, and will be deployed on transpacific and transatlantic routes that Delta said will produce a 20% saving in cash operating cost (COC) per seat versus the Boeing 747-400 and 767-300ER aircraft they will replace. This follows Delta’s strategy of establishing Seattle as its US West Coast hub for Asian flights to Hong Kong and Seoul Incheon and reducing its foreign exchange exposure to the depreciating Japanese yen by suspending Hong Kong-Tokyo Narita and Manila-Nagoya services, which in turn enables it to retire 4 gas-guzzling jumbos by the end of 2014 and their entirety by 2017.

“Delta always approaches fleet decisions with a balance of economic efficiency, customer experience enhancements, network integration and total cost of ownership. The A350 and A330neo support our long-haul, transoceanic strategy and join a mix of Boeing and Airbus aircraft that provide exceptional flexibility for Delta’s global network as well as strong cash-on-cash returns for our shareholders,” Delta Air Lines vice president (VP) of fleet strategy and transactions Nat Pieper said.

In a nutshell, Delta’s order loss highlights the essence of aircraft order campaigns – a package of pricing, availability, financing and increasingly other forms of assistance such as Airbus taking back 4 ageing A340-300s in 2016-17 and Boeing 5 A340-600s alongside Finnair and China Eastern Airlines’ respective orders for 8 A350-900s and 20 777-300ERs, not simply on the grounds of technical superiority.

“Boeing competed for the order with the 787-9, but we did not have enough 787 positions available in the timeframe that met Delta’s requirement,” Boeing said in a statement, with the Flightglobal Ascends Fleet databaseconfirming there are only 12 available slots in 2017.

For Chicago-based Boeing, this also lays bare the single biggest obstacle to maintaining and solidifying its

dominance is availability, rather than being significantly challenged in technical terms.

Dissecting A330neo & 787 in weight, fuel & operating efficiencies

Needless to say, Airbus begs to differ, which heralds the win, alongside CIT Group firming up its order for 15 A330-900neos, as a “massive endorsement”. Airbus says the 310-seat 6,000nm (nautical miles) A330-900neo, down from 6,200nm when launched, will provide a 14% lower fuel burn per seat against a Rolls-Royce Trent 772B-equipped A330-300 delivered in 2014 over a 4,000nm mission.

Much of this stems from the Rolls-Royce Trent 7000 engine, which accounts for 11% of the per-seat block fuel burn reduction, with another 4% stemming from the adoption of A350-styled sharklet which extends the A330-900neo’s wingspan by 3.7m to 64m and improves the aircraft’s lift-to-drag (L/D) ratio from 21 to 22. In addition, increased cabin efficiency (ICE) which adds 10 seats and brings its seat count to 310 in a 2-class configuration will lower this key metric of aircraft performance by a further 2%. This will partially offset by 4 tonnes of extra operating weight empty (OWE) resulting from the larger engine and the wing modifications and engine integration which shave 2% and 1% off the block fuel burn per seat reduction.

This, Airbus asserts, will augur well for the A330-900neo against a 304-seat 253-tonne 787-9 Dreamliner, with a 1% lower cash operating cost (COC) per seat and a 7% lower direct operating cost (DOC) per seat aided by a lower monthly lease rate at US$1.1 million versus the 787-9’s US$1.3 million.

Yet there exists a contrarian view that merits consideration.

First of all, the 11% installed engine performance appears optimistic, not least because it is being compared against a low base with the Rolls-Royce Trent 772B engine. The Enhanced Performance (EP) standard featuring improved fan and blade tip clearance on its high pressure compressor (HPC), intermediate pressure compressor (IPC), high pressure turbine (HPT), intermediate pressure turbine (IPT) and a re-bladed low pressure turbine (LPT), has already slashed the engine specific fuel consumption (SFC) by 1% since 2009. The EP2 improvement package that slashes SFC by another 1% will enter into service in 2015. They combined shave 2% of the claimed SFC reduction despite featuring an improved overall pressure ratio (OPR) from 35:1 to 50:1 and a doubled bypass ratio of 10:1 from 5:1.

One may also point to the fact that the Trent 7000 is based on the Trent 1000-TEN (thrust efficiency new technologies) engine, which missed its engine specific fuel consumption (SFC) target alongside the GE Aviation GEnx-1B engine on the Boeing 787 Dreamliner. The Trent 1000-TEN will only bring the engine close to Boeing’s original specification from Package C production standard which still misses the original SFC target by around 3%, according to Aspire Aviation‘s understanding. Further factoring in the 1% improvement in SFC from Package B to Package C standards, and 2.3% from Package A to Package B, it is clear that the engine faced a significant 6.3% SFC shortfall at service entry (“Boeing 777X & 787-10 show the lure of the X factor“, 2nd Jul, 13).

Likewise, flightglobal reported that GE Aviation had recalculated the GEnx-1B Block 4 standard’s performance and concluded that the Block 4 missed its original SFC target by 4-5% and the performance improvement package (PIP) I and II have only managed to narrow the gap to 1-2%.

Combined with a heavy 1970s fuselage, a 1980s wing and the addition of electrical bleed air system (EBAS), Boeing Capital Corporation (BCC) managing director (MD) of capital markets development lamented in Sydney that the A330neo is a concept “buried in 2004, resurrected in 2014″ and likened it to the A340, claiming “for those who liked cheap A340s, A330neo is the right solution”. Boeing views the A330neo as only 9-10% more fuel efficient than the existing A330, Aspire Aviation‘s sources at the Chicago-based planemaker revealed.

Moreover, the usual seat count debate also applies to the A330-900neo and 787-9 comparison. Airbus uses a 2-class 310-seat configuration for the A330-900neo, comprising 36 business class and 274 economy class seats, or 11.61% and 88.4% of the total. Boeing, in contrast, shows that its 2-class 787-9 is able to accommodate a total of 360 passengers, comprising 30 business and 330 economy seats, or 8.33% and 91.7% of the total.

Holding the seat ratio constant is important as business class seats, albeit in this case both in a 2-2-2 medium-haul configuration, are disproportionately heavier than economy seats. The 787-9 is able to accommodate 346 passengers in a 2-class arrangement at the same seat ratio of 11.61% business and 88.4% economy, Aspire Aviation calculates.

Airbus goes further in alleging that a 2-class 787-9 is only able to carry 304 passengers with a 16.9-inch economy seat width, and that its products come with “comfort without compromise”. Its proponents are also quick to cite Air Canada as an example, whose 251-seat 787-8 only has a 17.3-inch seat width and a 31-inch seat pitch in order to produce a 29% lower seat-mile costs than the airline’s 191-seat 767-300, which has a 17.8-inch width and 31-34 inches of pitch.

Yet Virgin Atlantic’s 264-seat 787-9 Dreamliner has 198 economy class seats with a 31-inch pitch and 18.9-inch width in a 9-abreast configuration, significantly wider than its A330-300s whose economy seat width is at 17.5-inch. At the end of the day, however, airlines should not be dictated by aircraft manufacturers as to how they design their interiors and there is little business sense in having a wide economy seat while being unable to make profits.

For the 787-9, it should be able to seat as many passengers as the A330-900neo at the very least, which also fits reality with Etihad Airways’ A330-300s and 787-9s both seating 231 passengers with a broadly similar seat ratio, and the same economy class seat width at 17.5-inch on both aircraft.

Most importantly, both the 787-8 and -9 remain lighter than their A330neo counterparts, which drive fuel and operating efficiencies.

Despite Airbus’s plan to shed 800kg of empty weight of the A330neo airframe, the 2-class 310-seat A330-900neo will be 4 tonnes heavier than the 300-seat A330-300, whose operating weight empty (OWE) will be 288,000lbs versus the around 279,000lbs on its predecessor. The 787-9 has an operating empty weight (OEW) of 277,000lbs, around 5 tonnes or 4% lighter than the A330-900neo.

On the 787-8, its OEW of 260,000lbs is 9.09 tonnes or 20,000lbs lighter than the A330-800neo’s 280,000lbs, amounting to a 7.7% advantage. On a 6,000nm mission, this will translate into a 9.9% lower block fuel burn per seat with the 787-8 using 526lbs of fuel per seat and the -800neo 578lbs.

In addition, Aspire Aviation‘s sources at Boeing contend, using a 253-tonne maximum take-off weight (MTOW) assumption on a 4,000nm mission comparison with the A330-900neo would unfairly penalise the -9, since such a sector length is less than half its 8,300nm range capability and would “unquestionably” not require the airplane operating at the 253-tonne MTOW condition. In assuming the engine operating at an unnecessarily high thrust, this will inevitably push up the 787-9’s landing fee, overflight fee as well as the engine’s direct maintenance cost (DMC).

When considering the flight crew cost, many also fail to account for the fact that the A330-900neo will continue to fly at a Mach 0.81 cruising speed whereas the 787-9 will be at M0.85, which will amount to a 25-minute difference on a 6,000nm mission, the same sources say.

Production stability key to volume game

When all is said and done, however, Boeing did lose Delta’s order. But it was not on technical grounds, but because of the lack of availability. Rectifying this means an ever increasing amount is at stake when it comes to ramping up the 787 production from 10 a month currently to 12 a month in 2016 and 14 by 2020.

Cutting the 787 cost is instrumental in giving Boeing further leverage on aircraft pricing and allowing it to become more aggressive in competing against the A330neo, whose production rate will be cut from 10 a month to 9 a month beginning 2015 fourth-quarter, given that low capital costs have been trumpeted as one of the A330neo’s biggest advantages, with Hawaiian Airlines chief commercial officer Peter Ingram saying “for a smaller capital cost increment than the A350s or the 787s, you get a good size chunk of the operating efficiencies in terms of fuel costs primarily and engine costs to a lesser extent”.

But analysts warn this will be challenging as the 787 deferred production cost balance reached US$25.2 billion at the end of 2014 third-quarter, a quarterly increase of US$947 million primarily owing to the US$200 million addition of 787-9 inventory to improve long-term productivity. Unit production cost only fell slightly to US$32 million during the quarter. UBS analysts forecast the deferred production balance will peak at US$28-29 billion whereas Buckingham analysts predict it will become larger than US$27 billion by 2016, despite the 787 programme turning “cash positive” in mid-2015.

Achieving this would require production stability, a pre-requisite not very well executed on the 787 programme. Ironically, Boeing should borrow a page from its transatlantic rival Airbus on the A350. The European Aviation Safety Agency (EASA) executive director Patrick Ky said “we dealt with a very mature” aircraft in certifying the 268-tonne and 275-tonne A350-900, which “is determined to be a variant of the A330/340 series aircraft” or “a variant of the A330-200″ with a maximum passenger number of 440 and an operating ceiling of 43,100ft. It is also certified by the EASA to be “beyond 180 minute” with either 300 or 370 minutes extended twin engine operations (ETOPS) options.

While the A350 has yet to enter into service and that early technical glitches are all but inevitable, its smooth flight test programme has lent confidence to the industry that hiccups of the 787 battery’s scale would not be repeated, despite Airbus planning to add lithium-ion battery as line-fit standard onto 2016 examples and beyond.

Although the US National Transportation Safety Board (NTSB) faulted Boeing that “the incident resulted from Boeing’s failure to incorporate design requirements to mitigate the most severe effects of an internal short circuit within an APU battery cell, and the FAA’s failure to identify this design deficiency during the type design certification process”, and the lithium-cobalt dioxide (Li-CoO2) battery manufacturer that “GS Yuasa did not test the battery under the most severe conditions possible in service, and the test battery was different than the final battery design certified for installation on the airplane”; more stringent oversight has been put in place with Boeing finding 17 instances of non-conformance by prime contractor Thales or subcontractor GS Yuasa, and that Boeing’s 3-layered solution worked.

The fact is a few dozens of batteries fail on the in-service fleet everyday, and when it does on a 787 again, especially under cold temperature when lithium buildup accumulates, the stainless steel case able to withstand an explosion, the dielectric and magnetic protection and a titanium tube venting any fluid and hot gas outside of the airplane will protect the 787 on an airplane level.

Putting the past aside, after fixing foam-like plugs going into the stringer, the proximity sensors within the slat skew detection mechanism assembly (DMA), the auxiliary power unit (APU) bowing issue due to hot air being trapped inside the compartment, and nuisance warnings, the 787 is becoming an increasingly mature airplane and edging towards its goal of having a 99.5% dispatch reliability by the second quarter of 2015.

Another sign of increasing production stability is the start of final assembly of Boeing South Carolina’s first 787-9, destined for United Airlines, on 22nd November and the improving order mix, a significant milestone for the -9 in achieving an equal split with its smaller sibling with 459 orders each following Air New Zealand (ANZ) and Virgin Atlantic ordering 2 and 1 additional examples, will arguably aid this process as the -9 features simpler parts such as the elimination of the side-of-body modifications that shaves 363kg (800lbs) in weight. These combined make the 787-9 being 500-1,000lbs below its manufacturer’s empty weight (MEW) specifications and later examples will be 2% lighter still (“Boeing 787 availability key in fending off A330neo“, 21st Feb, 14).

Getting this right is paramount as the A330neo, after a further temporary production cut, possibly to 6 per month by Bernstein Research’s reckoning, will be vying for a large replacement market alongside the 787. The lack of availability also explains the sluggish growth of 787-10 orders, which total 139 and will be exclusively built in Charleston, South Carolina (SC) as its 3m (10ft) longer mid-body fuselage would be too long for Dreamlifter transport.

“The A330neo is expected to bring production rates back up near current A330 levels. But, we believe, A330neo margins are likely to be weaker,” Bernstein Research analysts wrote in a 11th December note to clients.

And this is not just a very large A330 replacement market – the world’s largest A330-300 customer Cathay Pacific along with its wholly-owned subsidiary Dragonair operate 40 and 18 examples, respectively; Air China 49; Turkish Airlines 40; China Eastern Airlines (CEA) 35; Qatar Airways 33; Etihad 32 and even Delta Air Lines’ fleet of 32 examples consisting of 11 -200s and 21 -300 HGWs, with a further 10 242-tonne -300s that are on order whose final assemblyhas begun in early November and will be delivered in 2015 second-quarter; the mission creep of both the A330-300neo and 787-10 with respective range of 6,000nm and 7,000nm, mean they will become perfect A340 and 777-200ER replacements.

There are 422 777-200ERs with Air France having 25, United 74, American 40, to name a few, as well as 284 active A340s that are rife for replacement, according to airfleets.net, with Lufthansa and Iberia having 18 and 7 A340-300s. Iberia, for instance, opted for 8 A330-200s and 8 A350-900s for the role.

The 787-10, in particular, has a better cargo-hauling capability than both the A330-900neo and the A350-900 with a total cargo volume of 6,187ft³ (175m³) versus the A330-900neo’s 5,751ft³ (162.8m³) and the A350-900’s 6,088ft³. The 787-9 could also carry 13 tonnes of extra cargoes on 2,300nm longer range than the A330-900neo.

Given this, it is apparent who the real enemy is for Boeing: production stability.

777X leaves Airbus no choice but to re-engine A380

Ask the marketing personnel at Airbus and Boeing about the problem of availability and the lack thereof, and they would have little hesitation in saying it is a good problem to have.

However, the same cannot be said of Airbus’s flagship A380 superjumbo or the Boeing 747-8I Intercontinental, both of which are being increasingly cannibalised by the mini-jumbos – today’s 777-300ER and the 350-seat A350-1000 and 400-seat 777-9X in the future.

Citing a weaker than expected cargo market, Boeing last week announced a fresh production cut of the 747-8 rate from 18 a year to just 16 examples, or 1.3 per month from 1.5 per month. Its thinning backlog now stands at merely 39, comprising 13 orders for the freighter.

At the same time, Airbus Group chief financial officer (CFO) Harald Wilhelm said at the plane-maker’s annual Global Investor Forum that the A380 will break even on a unit basis from 2015 onwards till 2017, but not 2018 and beyond, after which it will have to ponder its future that “if we would do something on the product, or even if we would discontinue the product”.

The comment sparked outrage from the A380’s biggest customer Emirates, whose president Tim Clark branded it as a “gaffe” as the world’s largest international carrier is prepared to order 60-70 A380neos if launched. This caused Airbus executives to do some explaining, with Airbus Group chief executive Tom Enders saying “whatever decision we take on upgrading that aircraft will be based purely on economic terms” and Airbus chief executive Fabrice Bregier promising “we will one day launch a 380neo, we will one day launch a stretch. This is so obvious there is extra potential. We will get more customers”. Airbus sales chief John Leahy said it is working on 4 active campaigns with existing customers.

Indeed, there is mounting evidence Airbus will launch a re-engined A380neo when the decision time comes in 2015, not because of a solid business case, but because the Boeing 777X has left little choice for Airbus and the fact that Rolls-Royce will probably shoulder the bulk of the A380neo’s development cost. Aviation Week reported that Rolls-Royce and Airbus are nearing an initial accord for supplying engines powering the A380neo.

If anything, Airbus has held onto the same tale for the past 14 years, that the world needs an A380 in light of increasing airport congestions, and the number of mega-cities with more than 10,000 daily long-haul passengers will grow from 42 today to 71 by 2023, by which time more than 95% of long-haul traffic will originate from them.

At congested airports such as London Heathrow which operates at 98% capacity, the A380 can free up precious slots such as what British Airways (BA) has done in replacing 3 daily 747-400 flights to Los Angeles with 2 daily 469-seat A380 flights. In doing so, the number of total daily seats has decreased marginally by 1%, but a combination of improved traffic mix with a 5% increase in premium seats and a 7% decrease in non-premium seats, and a 19% lower trip cost leads to higher profitability. The A380 has worked so well for BA such that it brought forward 1 delivery from 2016 first-quarter to 2014 fourth-quarter.

Similar significant operational efficiencies could be gained at other carriers, such as Cathay Pacific’s 5 times daily London Heathrow services, Airbus and its proponents argue. CX251 and CX255 now depart 1 hours and 15 minutes within each other in midnight, then CX257, CX239 and CX253 departing in a 3 hours’ window of each other from 9am in the morning till 3pm in the afternoon.

Yet this argument has not translated into solid sales, with the A380’s 318 firm orders since December 2000 dwarfed by the A350 XWB’s 778 and the 787 Dreamliner’s 1,055 in considerably shorter timeframes. The A380’s remaining backlog of 147, while sufficient for sustaining an annual production rate of 30 until at least 2017, appears shaky, with Virgin Atlantic’s one for 6, Hong Kong Airlines’ 10, Air Austral’s 2, Air France’s last 2 orders likely to be cancelled, while lessor Amadeo has yet to land a single customer for its order of 20 examples, let alone Qantas’s remaining orders for 8 examples.

Boeing has offered a decidedly different observation, citing OAG schedules between 2000 and 2014 that while the number of frequencies and capacity increased by 58% and 60%, respectively, serving 46% more cities, the average number of seats per flight has decreased by 2% from 304 to 299 (“Airbus, Boeing in game of thrones for widebody dominance“, 11th Jul, 14).

The A380 or any very large airplane (VLA), its rationale goes, will remain a niche serving airlines’ a select few of trunk routes while being inherently financially risky.

Airlines appear to be siding with Boeing. International Airlines Group (IAG) chief executive Willie Walsh was quoted as saying “aircraft coming into Heathrow will generally be smaller” and has indicated that BA has no intention to grow its A380 fleet beyond 12 examples, despite an existing fleet of 43 747-400s. Air France-KLM Group’s chief executive Alexandre de Juniac even went as far as saying “it’s an excellent plane but it only works for the right destinations”.

Some of the A380’s problems, such as a small cargo space and trading frequency for capacity, already exist today.

The A380 has a total cargo volume of 5,875ft³ and a revenue cargo volume of 2,995ft³, whereas the 777-300ER has a 5,200ft³ revenue cargo volume out of a 7,120ft³ total cargo volume. For Emirates, this means a difference of hauling 8 tonnes and 23 tonnes of cargo, according to its website, while Cathay Pacific hauls 20 tonnes of revenue cargoes on each 777-300ER flights, which add up to 100 and 80 tonnes to London Heathrow and Los Angeles easily (“Cathay Pacific’s prospect poised to take flight“, 1st Oct, 14).

But the arrival of the 777X will hasten a step-change in efficiency, with the aircraft providing a 20% lower fuel burn per seat and a 15% lower cash operating cost (COC) per seat against the 368-seat 777-300ER, offering a balanced growth opportunity for carriers in the Asia/Pacific and Middle East without sacrificing frequencies and resulting in “spill-over demand”. The 400-seat 8,200nm 777-9X will also have a 12% lower block fuel burn per seat and a 10% lower COC per seat than the 344-seat A350-1000, Boeing claims.

What will exert pressure on Airbus to launch the A380neo is the fact that the 777-9X will lower the -300ER’s seat-mile costs by around 10% and given that the -300ER has roughly the same seat-mile costs as the A380 today, this will lead to a 10% gap between the -9X and the A380.

Furthermore, airlines, most likely Emirates, are asking for more seats on the 777-9X and that this would be announced in the second quarter of 2015, Aspire Aviation could exclusively reveal. When this change is announced, most likely entailing the addition of a few number of economy rows, the seat-mile cost gap will further widen.

The 777-9X’s ability to feature more seats is mainly enabled by tweaks to its interior arrangements such as galleys, despite a small stretch of its fuselage, informally dubbed as the “777-10X”, from 76.5m (250.11ft) to 76.7m (251.9ft), according to a September 2014 Boeing internal document obtained by Aspire Aviation. Assuming the addition of 2 rows or 20 seats, these refinement and cabin changes will make it 420-seat and a one-to-one 747-400 replacement, further enticing British Airways with 43 ageing jumbos, KLM 23, United Airlines 24, Korean Air 14, Thai Airways 12, Air France 7 and Qantas’s 9 remaining examples to place orders.

In other words, the 777-9X will exacerbate the A380’s problems. While Airbus continues to deride the 777X as a “paper airplane”, Boeing is fast-tracking the 777X development with a “manage-to” internal entry into service (EIS) target 6 months earlier than the 2020 second-quarter public target following a 9-month flight test campaign.

It has already signed a long-term contract extension with Toray Industries, effective from 2015 onwards, to supply aerospace carbon fibre reinforced polymer (CFRP) for the 777X’s supercritical 4th-generation CFRP wing, which will be built at a US$1 billion sprawling 1 million ft² new facility in Everett, Washington. The facility will have 3 giant autoclaves co-curing the front and rear CFRP wing spars, stringers with the uncured wing panels, before being sent to the main assembly building, which will occupy the current 3rd 787 temporary surge line for 3 years in the 777X’s initial production phase, according to The Seattle Times. The facility on October 21st celebrated its groundbreaking 7 weeks ahead of schedule and will be complete by May 2016.

Boeing also signed an agreement with Japanese partners Mitsubishi Heavy Industries (MHI), Fuji Heavy Industries (FHI) and Kawasaki Heavy Industries (KHI) guaranteeing a continuation of their existing work, totalling 21% of today’s 777s, on the 777X. In addition, AVIC Shenyang Commercial Aircraft Corporation (SACC) will build the 777X’s empennage tips, whereas St. Louis is assigned responsibility for producing 777X wing parts, replacing Boeing Aerostructures Australia and outside partners.

The same Boeing internal document also reveals that it has started engaging airlines and airports on the 777X’s airport compatibility early, and included alternate and extended twin engine operations (ETOPS) airports from the beginning, even ahead of the firm configuration in mid-2015.

For 2014’s focus of alternate and ETOPS airports, Boeing talked to Nagoya, Osaka Kansai International, Taipei, Kaohsiung, Macau, Ho Chi Minh City, Penang and Batam, Brisbane, Auckland and Melbourne in the Asia/Pacific region; London Gatwick, Paris Orly, Milan, Hannover, Cologne, Brussels, Copenhagen in Europe; Chicago Rockford International Airport, Milwaukee, Detroit, Toronto, Boston, Newark, Philadelphia, Baltimore, Indianapolis, Dallas/Fort Worth, Denver, Portland, Salt Lake City, Oakland, Ontario, Las Vegas in North America.

Boeing also initiated the process to get the folding wingtip (FWT) in design documentations in 2013 with a November 2016 approval for the International Civil Aviation Organisation (ICAO) Annex 14 being eyed. Boeing said in the document that “both EASA and the FAA support the reduction” for reduced wingtip clearance.

This is important as the 777-9X is designed to fit today’s Code E airport gates over a 64.8m (212.9ft) wingspan with the folding wingtip (FWT) in the folded up position while taking less than 20 seconds to unfold and extend its wingspan to 71.8m (235.5ft) just before entering the runway. This Code E compatibility will make most of the world’s airports accessible to the 777X.

While Boeing has already developed the airport operation procedures for the FWT failures, at 1 per 100,000 dispatches, under which the FWT will be in a locked and latched position, Aspire Aviation‘s sources at Boeing say the 777X can only be de-iced with the FWT folded down at Code F gates, potentially adding a layer of complexity to the 777X’s ground operations in wintertime.

All told, with the industry body International Air Transport Association (IATA) forecasting 1.8 billion extra annual passengers from Asia/Pacific at a 4.9% annual growth rate, 559 million extra annual passengers in the US market and 266 million in India over the next 20 years, Boeing is betting that the 777-9X will be positioned at a future sweet spot of around 400 seats, moving up from today’s sweet spot of around 350 seats.

With sufficient availability, it is hopeful that the 777-9X will be able to take on not just the A380 and be a 777-300ER replacement, but also the A350-1000 and A380neo in one fell swoop, giving airlines flexibility not limited to niche roles such as Royal Air Maroc’s Hajj flights, but also profitably operate the aircraft on a large number of an airline’s routes.

Availability is the new name of the game.

Download Boeing’s internal Sep 2014 777X update >>

http://www.aspireaviation.com/2014/12/16/delta-loss-shows-availability-key-to-boeings-widebody-strategy/

Delta loss shows availability key to Boeing’s widebody strategy

- Boeing stretches 777-9X fuselage from 76.5m to 76.7m: exclusive

- Airlines, most likely Emirates, asking for more seats on 777X: sources

- Boeing to announce more seats on 777-9X in Q2 2015: sources

- 777X de-icing can only take place at Code F stands with FWT down

- 787-9 OEW 277,000lbs is 11,000lbs lighter than A330-900neo’s 288,000lbs

- 787-8 OEW 260,000lbs versus A330-800neo’s 280,000lbs

- 787-8 is 9% more fuel efficient per seat than -800neo on 6,000nm missions

- Using 253t 787-9 in A330neo comparison pushes up -9’s landing & overflight fee, DMC

- 787-9 carries 13 tonnes more revenue cargo than A330-900neo

- A330neo Mach 0.81 means 25 mins longer flying time on 6,000nm missions

- Virgin Atlantic 787-9 has 9-abreast economy seats at 18.9-inch width

- Boeing sees A330neo 9-10% more fuel efficient than A330: sources

- 777-300ER carries 23t of cargo, A380 only 8t: Emirates

Airbus has much to celebrate when Qatar Airways eventually takes delivery of its first A350-900 on December 22nd, despite a last-minute delay in the official ceremony over minor issues. Not only did it run a flawless 2,600-hour, 680-sortie flight test programme in record time, resulting in its type certificate being earnt from the European Aviation Safety Agency (EASA) on 30th September, 14.5 months since first flight, Airbus also won a significant order from the third-largest US carrier Delta Air Lines which opted for 25 Airbus A350-900s and 25 re-engined A330-900neos (new engine options).

The first deliveries of the A350-900 and A330-900neo will begin in 2017 second quarter and 2019, respectively, and will be deployed on transpacific and transatlantic routes that Delta said will produce a 20% saving in cash operating cost (COC) per seat versus the Boeing 747-400 and 767-300ER aircraft they will replace. This follows Delta’s strategy of establishing Seattle as its US West Coast hub for Asian flights to Hong Kong and Seoul Incheon and reducing its foreign exchange exposure to the depreciating Japanese yen by suspending Hong Kong-Tokyo Narita and Manila-Nagoya services, which in turn enables it to retire 4 gas-guzzling jumbos by the end of 2014 and their entirety by 2017.

“Delta always approaches fleet decisions with a balance of economic efficiency, customer experience enhancements, network integration and total cost of ownership. The A350 and A330neo support our long-haul, transoceanic strategy and join a mix of Boeing and Airbus aircraft that provide exceptional flexibility for Delta’s global network as well as strong cash-on-cash returns for our shareholders,” Delta Air Lines vice president (VP) of fleet strategy and transactions Nat Pieper said.

In a nutshell, Delta’s order loss highlights the essence of aircraft order campaigns – a package of pricing, availability, financing and increasingly other forms of assistance such as Airbus taking back 4 ageing A340-300s in 2016-17 and Boeing 5 A340-600s alongside Finnair and China Eastern Airlines’ respective orders for 8 A350-900s and 20 777-300ERs, not simply on the grounds of technical superiority.

“Boeing competed for the order with the 787-9, but we did not have enough 787 positions available in the timeframe that met Delta’s requirement,” Boeing said in a statement, with the Flightglobal Ascends Fleet databaseconfirming there are only 12 available slots in 2017.

For Chicago-based Boeing, this also lays bare the single biggest obstacle to maintaining and solidifying its

dominance is availability, rather than being significantly challenged in technical terms.

Dissecting A330neo & 787 in weight, fuel & operating efficiencies

Needless to say, Airbus begs to differ, which heralds the win, alongside CIT Group firming up its order for 15 A330-900neos, as a “massive endorsement”. Airbus says the 310-seat 6,000nm (nautical miles) A330-900neo, down from 6,200nm when launched, will provide a 14% lower fuel burn per seat against a Rolls-Royce Trent 772B-equipped A330-300 delivered in 2014 over a 4,000nm mission.

Much of this stems from the Rolls-Royce Trent 7000 engine, which accounts for 11% of the per-seat block fuel burn reduction, with another 4% stemming from the adoption of A350-styled sharklet which extends the A330-900neo’s wingspan by 3.7m to 64m and improves the aircraft’s lift-to-drag (L/D) ratio from 21 to 22. In addition, increased cabin efficiency (ICE) which adds 10 seats and brings its seat count to 310 in a 2-class configuration will lower this key metric of aircraft performance by a further 2%. This will partially offset by 4 tonnes of extra operating weight empty (OWE) resulting from the larger engine and the wing modifications and engine integration which shave 2% and 1% off the block fuel burn per seat reduction.

This, Airbus asserts, will augur well for the A330-900neo against a 304-seat 253-tonne 787-9 Dreamliner, with a 1% lower cash operating cost (COC) per seat and a 7% lower direct operating cost (DOC) per seat aided by a lower monthly lease rate at US$1.1 million versus the 787-9’s US$1.3 million.

Yet there exists a contrarian view that merits consideration.

First of all, the 11% installed engine performance appears optimistic, not least because it is being compared against a low base with the Rolls-Royce Trent 772B engine. The Enhanced Performance (EP) standard featuring improved fan and blade tip clearance on its high pressure compressor (HPC), intermediate pressure compressor (IPC), high pressure turbine (HPT), intermediate pressure turbine (IPT) and a re-bladed low pressure turbine (LPT), has already slashed the engine specific fuel consumption (SFC) by 1% since 2009. The EP2 improvement package that slashes SFC by another 1% will enter into service in 2015. They combined shave 2% of the claimed SFC reduction despite featuring an improved overall pressure ratio (OPR) from 35:1 to 50:1 and a doubled bypass ratio of 10:1 from 5:1.

One may also point to the fact that the Trent 7000 is based on the Trent 1000-TEN (thrust efficiency new technologies) engine, which missed its engine specific fuel consumption (SFC) target alongside the GE Aviation GEnx-1B engine on the Boeing 787 Dreamliner. The Trent 1000-TEN will only bring the engine close to Boeing’s original specification from Package C production standard which still misses the original SFC target by around 3%, according to Aspire Aviation‘s understanding. Further factoring in the 1% improvement in SFC from Package B to Package C standards, and 2.3% from Package A to Package B, it is clear that the engine faced a significant 6.3% SFC shortfall at service entry (“Boeing 777X & 787-10 show the lure of the X factor“, 2nd Jul, 13).

Likewise, flightglobal reported that GE Aviation had recalculated the GEnx-1B Block 4 standard’s performance and concluded that the Block 4 missed its original SFC target by 4-5% and the performance improvement package (PIP) I and II have only managed to narrow the gap to 1-2%.

Combined with a heavy 1970s fuselage, a 1980s wing and the addition of electrical bleed air system (EBAS), Boeing Capital Corporation (BCC) managing director (MD) of capital markets development lamented in Sydney that the A330neo is a concept “buried in 2004, resurrected in 2014″ and likened it to the A340, claiming “for those who liked cheap A340s, A330neo is the right solution”. Boeing views the A330neo as only 9-10% more fuel efficient than the existing A330, Aspire Aviation‘s sources at the Chicago-based planemaker revealed.

Moreover, the usual seat count debate also applies to the A330-900neo and 787-9 comparison. Airbus uses a 2-class 310-seat configuration for the A330-900neo, comprising 36 business class and 274 economy class seats, or 11.61% and 88.4% of the total. Boeing, in contrast, shows that its 2-class 787-9 is able to accommodate a total of 360 passengers, comprising 30 business and 330 economy seats, or 8.33% and 91.7% of the total.

Holding the seat ratio constant is important as business class seats, albeit in this case both in a 2-2-2 medium-haul configuration, are disproportionately heavier than economy seats. The 787-9 is able to accommodate 346 passengers in a 2-class arrangement at the same seat ratio of 11.61% business and 88.4% economy, Aspire Aviation calculates.

Airbus goes further in alleging that a 2-class 787-9 is only able to carry 304 passengers with a 16.9-inch economy seat width, and that its products come with “comfort without compromise”. Its proponents are also quick to cite Air Canada as an example, whose 251-seat 787-8 only has a 17.3-inch seat width and a 31-inch seat pitch in order to produce a 29% lower seat-mile costs than the airline’s 191-seat 767-300, which has a 17.8-inch width and 31-34 inches of pitch.

Yet Virgin Atlantic’s 264-seat 787-9 Dreamliner has 198 economy class seats with a 31-inch pitch and 18.9-inch width in a 9-abreast configuration, significantly wider than its A330-300s whose economy seat width is at 17.5-inch. At the end of the day, however, airlines should not be dictated by aircraft manufacturers as to how they design their interiors and there is little business sense in having a wide economy seat while being unable to make profits.

For the 787-9, it should be able to seat as many passengers as the A330-900neo at the very least, which also fits reality with Etihad Airways’ A330-300s and 787-9s both seating 231 passengers with a broadly similar seat ratio, and the same economy class seat width at 17.5-inch on both aircraft.

Most importantly, both the 787-8 and -9 remain lighter than their A330neo counterparts, which drive fuel and operating efficiencies.

Despite Airbus’s plan to shed 800kg of empty weight of the A330neo airframe, the 2-class 310-seat A330-900neo will be 4 tonnes heavier than the 300-seat A330-300, whose operating weight empty (OWE) will be 288,000lbs versus the around 279,000lbs on its predecessor. The 787-9 has an operating empty weight (OEW) of 277,000lbs, around 5 tonnes or 4% lighter than the A330-900neo.

On the 787-8, its OEW of 260,000lbs is 9.09 tonnes or 20,000lbs lighter than the A330-800neo’s 280,000lbs, amounting to a 7.7% advantage. On a 6,000nm mission, this will translate into a 9.9% lower block fuel burn per seat with the 787-8 using 526lbs of fuel per seat and the -800neo 578lbs.

In addition, Aspire Aviation‘s sources at Boeing contend, using a 253-tonne maximum take-off weight (MTOW) assumption on a 4,000nm mission comparison with the A330-900neo would unfairly penalise the -9, since such a sector length is less than half its 8,300nm range capability and would “unquestionably” not require the airplane operating at the 253-tonne MTOW condition. In assuming the engine operating at an unnecessarily high thrust, this will inevitably push up the 787-9’s landing fee, overflight fee as well as the engine’s direct maintenance cost (DMC).

When considering the flight crew cost, many also fail to account for the fact that the A330-900neo will continue to fly at a Mach 0.81 cruising speed whereas the 787-9 will be at M0.85, which will amount to a 25-minute difference on a 6,000nm mission, the same sources say.

Production stability key to volume game

When all is said and done, however, Boeing did lose Delta’s order. But it was not on technical grounds, but because of the lack of availability. Rectifying this means an ever increasing amount is at stake when it comes to ramping up the 787 production from 10 a month currently to 12 a month in 2016 and 14 by 2020.

Cutting the 787 cost is instrumental in giving Boeing further leverage on aircraft pricing and allowing it to become more aggressive in competing against the A330neo, whose production rate will be cut from 10 a month to 9 a month beginning 2015 fourth-quarter, given that low capital costs have been trumpeted as one of the A330neo’s biggest advantages, with Hawaiian Airlines chief commercial officer Peter Ingram saying “for a smaller capital cost increment than the A350s or the 787s, you get a good size chunk of the operating efficiencies in terms of fuel costs primarily and engine costs to a lesser extent”.

But analysts warn this will be challenging as the 787 deferred production cost balance reached US$25.2 billion at the end of 2014 third-quarter, a quarterly increase of US$947 million primarily owing to the US$200 million addition of 787-9 inventory to improve long-term productivity. Unit production cost only fell slightly to US$32 million during the quarter. UBS analysts forecast the deferred production balance will peak at US$28-29 billion whereas Buckingham analysts predict it will become larger than US$27 billion by 2016, despite the 787 programme turning “cash positive” in mid-2015.

Achieving this would require production stability, a pre-requisite not very well executed on the 787 programme. Ironically, Boeing should borrow a page from its transatlantic rival Airbus on the A350. The European Aviation Safety Agency (EASA) executive director Patrick Ky said “we dealt with a very mature” aircraft in certifying the 268-tonne and 275-tonne A350-900, which “is determined to be a variant of the A330/340 series aircraft” or “a variant of the A330-200″ with a maximum passenger number of 440 and an operating ceiling of 43,100ft. It is also certified by the EASA to be “beyond 180 minute” with either 300 or 370 minutes extended twin engine operations (ETOPS) options.

While the A350 has yet to enter into service and that early technical glitches are all but inevitable, its smooth flight test programme has lent confidence to the industry that hiccups of the 787 battery’s scale would not be repeated, despite Airbus planning to add lithium-ion battery as line-fit standard onto 2016 examples and beyond.

Although the US National Transportation Safety Board (NTSB) faulted Boeing that “the incident resulted from Boeing’s failure to incorporate design requirements to mitigate the most severe effects of an internal short circuit within an APU battery cell, and the FAA’s failure to identify this design deficiency during the type design certification process”, and the lithium-cobalt dioxide (Li-CoO2) battery manufacturer that “GS Yuasa did not test the battery under the most severe conditions possible in service, and the test battery was different than the final battery design certified for installation on the airplane”; more stringent oversight has been put in place with Boeing finding 17 instances of non-conformance by prime contractor Thales or subcontractor GS Yuasa, and that Boeing’s 3-layered solution worked.

The fact is a few dozens of batteries fail on the in-service fleet everyday, and when it does on a 787 again, especially under cold temperature when lithium buildup accumulates, the stainless steel case able to withstand an explosion, the dielectric and magnetic protection and a titanium tube venting any fluid and hot gas outside of the airplane will protect the 787 on an airplane level.

Putting the past aside, after fixing foam-like plugs going into the stringer, the proximity sensors within the slat skew detection mechanism assembly (DMA), the auxiliary power unit (APU) bowing issue due to hot air being trapped inside the compartment, and nuisance warnings, the 787 is becoming an increasingly mature airplane and edging towards its goal of having a 99.5% dispatch reliability by the second quarter of 2015.

Another sign of increasing production stability is the start of final assembly of Boeing South Carolina’s first 787-9, destined for United Airlines, on 22nd November and the improving order mix, a significant milestone for the -9 in achieving an equal split with its smaller sibling with 459 orders each following Air New Zealand (ANZ) and Virgin Atlantic ordering 2 and 1 additional examples, will arguably aid this process as the -9 features simpler parts such as the elimination of the side-of-body modifications that shaves 363kg (800lbs) in weight. These combined make the 787-9 being 500-1,000lbs below its manufacturer’s empty weight (MEW) specifications and later examples will be 2% lighter still (“Boeing 787 availability key in fending off A330neo“, 21st Feb, 14).

Getting this right is paramount as the A330neo, after a further temporary production cut, possibly to 6 per month by Bernstein Research’s reckoning, will be vying for a large replacement market alongside the 787. The lack of availability also explains the sluggish growth of 787-10 orders, which total 139 and will be exclusively built in Charleston, South Carolina (SC) as its 3m (10ft) longer mid-body fuselage would be too long for Dreamlifter transport.

“The A330neo is expected to bring production rates back up near current A330 levels. But, we believe, A330neo margins are likely to be weaker,” Bernstein Research analysts wrote in a 11th December note to clients.

And this is not just a very large A330 replacement market – the world’s largest A330-300 customer Cathay Pacific along with its wholly-owned subsidiary Dragonair operate 40 and 18 examples, respectively; Air China 49; Turkish Airlines 40; China Eastern Airlines (CEA) 35; Qatar Airways 33; Etihad 32 and even Delta Air Lines’ fleet of 32 examples consisting of 11 -200s and 21 -300 HGWs, with a further 10 242-tonne -300s that are on order whose final assemblyhas begun in early November and will be delivered in 2015 second-quarter; the mission creep of both the A330-300neo and 787-10 with respective range of 6,000nm and 7,000nm, mean they will become perfect A340 and 777-200ER replacements.

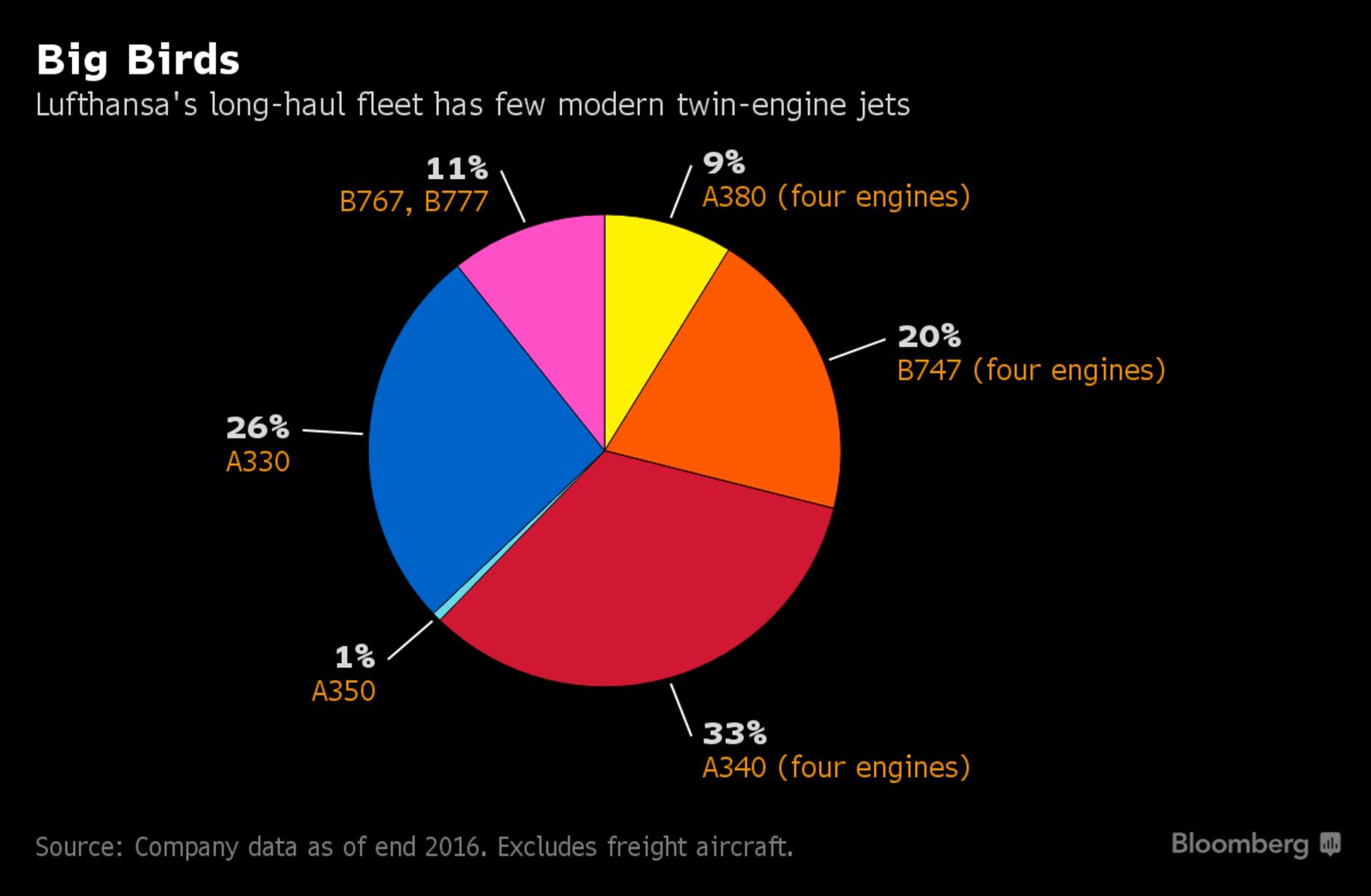

There are 422 777-200ERs with Air France having 25, United 74, American 40, to name a few, as well as 284 active A340s that are rife for replacement, according to airfleets.net, with Lufthansa and Iberia having 18 and 7 A340-300s. Iberia, for instance, opted for 8 A330-200s and 8 A350-900s for the role.

The 787-10, in particular, has a better cargo-hauling capability than both the A330-900neo and the A350-900 with a total cargo volume of 6,187ft³ (175m³) versus the A330-900neo’s 5,751ft³ (162.8m³) and the A350-900’s 6,088ft³. The 787-9 could also carry 13 tonnes of extra cargoes on 2,300nm longer range than the A330-900neo.

Given this, it is apparent who the real enemy is for Boeing: production stability.

777X leaves Airbus no choice but to re-engine A380

Ask the marketing personnel at Airbus and Boeing about the problem of availability and the lack thereof, and they would have little hesitation in saying it is a good problem to have.

However, the same cannot be said of Airbus’s flagship A380 superjumbo or the Boeing 747-8I Intercontinental, both of which are being increasingly cannibalised by the mini-jumbos – today’s 777-300ER and the 350-seat A350-1000 and 400-seat 777-9X in the future.

Citing a weaker than expected cargo market, Boeing last week announced a fresh production cut of the 747-8 rate from 18 a year to just 16 examples, or 1.3 per month from 1.5 per month. Its thinning backlog now stands at merely 39, comprising 13 orders for the freighter.

At the same time, Airbus Group chief financial officer (CFO) Harald Wilhelm said at the plane-maker’s annual Global Investor Forum that the A380 will break even on a unit basis from 2015 onwards till 2017, but not 2018 and beyond, after which it will have to ponder its future that “if we would do something on the product, or even if we would discontinue the product”.

The comment sparked outrage from the A380’s biggest customer Emirates, whose president Tim Clark branded it as a “gaffe” as the world’s largest international carrier is prepared to order 60-70 A380neos if launched. This caused Airbus executives to do some explaining, with Airbus Group chief executive Tom Enders saying “whatever decision we take on upgrading that aircraft will be based purely on economic terms” and Airbus chief executive Fabrice Bregier promising “we will one day launch a 380neo, we will one day launch a stretch. This is so obvious there is extra potential. We will get more customers”. Airbus sales chief John Leahy said it is working on 4 active campaigns with existing customers.

Indeed, there is mounting evidence Airbus will launch a re-engined A380neo when the decision time comes in 2015, not because of a solid business case, but because the Boeing 777X has left little choice for Airbus and the fact that Rolls-Royce will probably shoulder the bulk of the A380neo’s development cost. Aviation Week reported that Rolls-Royce and Airbus are nearing an initial accord for supplying engines powering the A380neo.

If anything, Airbus has held onto the same tale for the past 14 years, that the world needs an A380 in light of increasing airport congestions, and the number of mega-cities with more than 10,000 daily long-haul passengers will grow from 42 today to 71 by 2023, by which time more than 95% of long-haul traffic will originate from them.

At congested airports such as London Heathrow which operates at 98% capacity, the A380 can free up precious slots such as what British Airways (BA) has done in replacing 3 daily 747-400 flights to Los Angeles with 2 daily 469-seat A380 flights. In doing so, the number of total daily seats has decreased marginally by 1%, but a combination of improved traffic mix with a 5% increase in premium seats and a 7% decrease in non-premium seats, and a 19% lower trip cost leads to higher profitability. The A380 has worked so well for BA such that it brought forward 1 delivery from 2016 first-quarter to 2014 fourth-quarter.

Similar significant operational efficiencies could be gained at other carriers, such as Cathay Pacific’s 5 times daily London Heathrow services, Airbus and its proponents argue. CX251 and CX255 now depart 1 hours and 15 minutes within each other in midnight, then CX257, CX239 and CX253 departing in a 3 hours’ window of each other from 9am in the morning till 3pm in the afternoon.

Yet this argument has not translated into solid sales, with the A380’s 318 firm orders since December 2000 dwarfed by the A350 XWB’s 778 and the 787 Dreamliner’s 1,055 in considerably shorter timeframes. The A380’s remaining backlog of 147, while sufficient for sustaining an annual production rate of 30 until at least 2017, appears shaky, with Virgin Atlantic’s one for 6, Hong Kong Airlines’ 10, Air Austral’s 2, Air France’s last 2 orders likely to be cancelled, while lessor Amadeo has yet to land a single customer for its order of 20 examples, let alone Qantas’s remaining orders for 8 examples.

Boeing has offered a decidedly different observation, citing OAG schedules between 2000 and 2014 that while the number of frequencies and capacity increased by 58% and 60%, respectively, serving 46% more cities, the average number of seats per flight has decreased by 2% from 304 to 299 (“Airbus, Boeing in game of thrones for widebody dominance“, 11th Jul, 14).

The A380 or any very large airplane (VLA), its rationale goes, will remain a niche serving airlines’ a select few of trunk routes while being inherently financially risky.

Airlines appear to be siding with Boeing. International Airlines Group (IAG) chief executive Willie Walsh was quoted as saying “aircraft coming into Heathrow will generally be smaller” and has indicated that BA has no intention to grow its A380 fleet beyond 12 examples, despite an existing fleet of 43 747-400s. Air France-KLM Group’s chief executive Alexandre de Juniac even went as far as saying “it’s an excellent plane but it only works for the right destinations”.

Some of the A380’s problems, such as a small cargo space and trading frequency for capacity, already exist today.

The A380 has a total cargo volume of 5,875ft³ and a revenue cargo volume of 2,995ft³, whereas the 777-300ER has a 5,200ft³ revenue cargo volume out of a 7,120ft³ total cargo volume. For Emirates, this means a difference of hauling 8 tonnes and 23 tonnes of cargo, according to its website, while Cathay Pacific hauls 20 tonnes of revenue cargoes on each 777-300ER flights, which add up to 100 and 80 tonnes to London Heathrow and Los Angeles easily (“Cathay Pacific’s prospect poised to take flight“, 1st Oct, 14).

But the arrival of the 777X will hasten a step-change in efficiency, with the aircraft providing a 20% lower fuel burn per seat and a 15% lower cash operating cost (COC) per seat against the 368-seat 777-300ER, offering a balanced growth opportunity for carriers in the Asia/Pacific and Middle East without sacrificing frequencies and resulting in “spill-over demand”. The 400-seat 8,200nm 777-9X will also have a 12% lower block fuel burn per seat and a 10% lower COC per seat than the 344-seat A350-1000, Boeing claims.

What will exert pressure on Airbus to launch the A380neo is the fact that the 777-9X will lower the -300ER’s seat-mile costs by around 10% and given that the -300ER has roughly the same seat-mile costs as the A380 today, this will lead to a 10% gap between the -9X and the A380.

Furthermore, airlines, most likely Emirates, are asking for more seats on the 777-9X and that this would be announced in the second quarter of 2015, Aspire Aviation could exclusively reveal. When this change is announced, most likely entailing the addition of a few number of economy rows, the seat-mile cost gap will further widen.

The 777-9X’s ability to feature more seats is mainly enabled by tweaks to its interior arrangements such as galleys, despite a small stretch of its fuselage, informally dubbed as the “777-10X”, from 76.5m (250.11ft) to 76.7m (251.9ft), according to a September 2014 Boeing internal document obtained by Aspire Aviation. Assuming the addition of 2 rows or 20 seats, these refinement and cabin changes will make it 420-seat and a one-to-one 747-400 replacement, further enticing British Airways with 43 ageing jumbos, KLM 23, United Airlines 24, Korean Air 14, Thai Airways 12, Air France 7 and Qantas’s 9 remaining examples to place orders.

In other words, the 777-9X will exacerbate the A380’s problems. While Airbus continues to deride the 777X as a “paper airplane”, Boeing is fast-tracking the 777X development with a “manage-to” internal entry into service (EIS) target 6 months earlier than the 2020 second-quarter public target following a 9-month flight test campaign.

It has already signed a long-term contract extension with Toray Industries, effective from 2015 onwards, to supply aerospace carbon fibre reinforced polymer (CFRP) for the 777X’s supercritical 4th-generation CFRP wing, which will be built at a US$1 billion sprawling 1 million ft² new facility in Everett, Washington. The facility will have 3 giant autoclaves co-curing the front and rear CFRP wing spars, stringers with the uncured wing panels, before being sent to the main assembly building, which will occupy the current 3rd 787 temporary surge line for 3 years in the 777X’s initial production phase, according to The Seattle Times. The facility on October 21st celebrated its groundbreaking 7 weeks ahead of schedule and will be complete by May 2016.

Boeing also signed an agreement with Japanese partners Mitsubishi Heavy Industries (MHI), Fuji Heavy Industries (FHI) and Kawasaki Heavy Industries (KHI) guaranteeing a continuation of their existing work, totalling 21% of today’s 777s, on the 777X. In addition, AVIC Shenyang Commercial Aircraft Corporation (SACC) will build the 777X’s empennage tips, whereas St. Louis is assigned responsibility for producing 777X wing parts, replacing Boeing Aerostructures Australia and outside partners.

The same Boeing internal document also reveals that it has started engaging airlines and airports on the 777X’s airport compatibility early, and included alternate and extended twin engine operations (ETOPS) airports from the beginning, even ahead of the firm configuration in mid-2015.

For 2014’s focus of alternate and ETOPS airports, Boeing talked to Nagoya, Osaka Kansai International, Taipei, Kaohsiung, Macau, Ho Chi Minh City, Penang and Batam, Brisbane, Auckland and Melbourne in the Asia/Pacific region; London Gatwick, Paris Orly, Milan, Hannover, Cologne, Brussels, Copenhagen in Europe; Chicago Rockford International Airport, Milwaukee, Detroit, Toronto, Boston, Newark, Philadelphia, Baltimore, Indianapolis, Dallas/Fort Worth, Denver, Portland, Salt Lake City, Oakland, Ontario, Las Vegas in North America.

Boeing also initiated the process to get the folding wingtip (FWT) in design documentations in 2013 with a November 2016 approval for the International Civil Aviation Organisation (ICAO) Annex 14 being eyed. Boeing said in the document that “both EASA and the FAA support the reduction” for reduced wingtip clearance.

This is important as the 777-9X is designed to fit today’s Code E airport gates over a 64.8m (212.9ft) wingspan with the folding wingtip (FWT) in the folded up position while taking less than 20 seconds to unfold and extend its wingspan to 71.8m (235.5ft) just before entering the runway. This Code E compatibility will make most of the world’s airports accessible to the 777X.

While Boeing has already developed the airport operation procedures for the FWT failures, at 1 per 100,000 dispatches, under which the FWT will be in a locked and latched position, Aspire Aviation‘s sources at Boeing say the 777X can only be de-iced with the FWT folded down at Code F gates, potentially adding a layer of complexity to the 777X’s ground operations in wintertime.

All told, with the industry body International Air Transport Association (IATA) forecasting 1.8 billion extra annual passengers from Asia/Pacific at a 4.9% annual growth rate, 559 million extra annual passengers in the US market and 266 million in India over the next 20 years, Boeing is betting that the 777-9X will be positioned at a future sweet spot of around 400 seats, moving up from today’s sweet spot of around 350 seats.

With sufficient availability, it is hopeful that the 777-9X will be able to take on not just the A380 and be a 777-300ER replacement, but also the A350-1000 and A380neo in one fell swoop, giving airlines flexibility not limited to niche roles such as Royal Air Maroc’s Hajj flights, but also profitably operate the aircraft on a large number of an airline’s routes.

Availability is the new name of the game.

Download Boeing’s internal Sep 2014 777X update >>

http://www.aspireaviation.com/2014/12/16/delta-loss-shows-availability-key-to-boeings-widebody-strategy/