Re: Norwegian apre il lungo raggio da Londra Gatwick

Ci dovrebbero essere dei voli L/H anche da Parigi dal prossimo anno.

Barcellona e Roma anche nel radar, ma al momento non ci sono aeromobili abbastanza.

Norwegian Air Shuttle targets long haul via UK

Norwegian Air Shuttle has revealed plans to set up a UK subsidiary as the low-cost airline sets its sight on further expansion in the long-haul market.

Bjorn Kjos, chief executive at Norwegian, told the Financial Times the airline was in the process of obtaining a UK operating licence, which would enable it fly to new destinations in Africa, India and South America.

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email

ftsales.support@ft.com to buy additional rights.

http://www.ft.com/cms/s/0/686fa236-2589-11e5-bd83-71cb60e8f08c.html#ixzz3fOOLX7XD

But the move could also help Norwegian overcome opposition from the US to its transatlantic expansion, according to industry experts.

Europe’s third-biggest low-cost airline is in the middle of a lengthy dispute with Washington regulators over its proposals to operate flights from Europe to the US using aircraft registered in Ireland.

Both US airlines and trade unions have lobbied hard against granting Norwegian permission to fly into the US under these arrangements, claiming the carrier is seeking to use an Irish operating licence to sidestep Norway’s high labour costs when hiring crew.

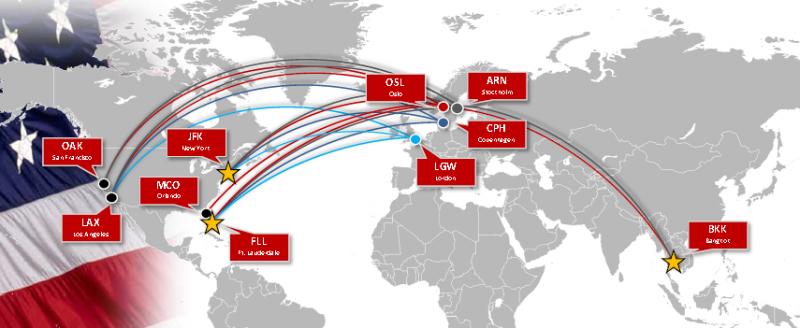

A UK operating licence for Norwegian — which already operates flights from London’s Gatwick airport to four US destinations — could help defuse the US row, said two analysts who declined to be named. The licence would also enable Norwegian to take advantage of Britain’s bilateral traffic agreements with India as well as countries in Africa and South America.

While US regulators have so far failed to give permission to Norwegian’s Irish subsidiary to operate flights to the US, Mr Kjos said the airline will get the green light “sooner or later”.

“The US airlines hate Norwegian because we are flying with low fares,” he said. “They are trying to protect their turf by all means.”

A former fighter jet pilot and author of crime novels, Mr Kjos has shaken up the Scandinavian market with much of the same chutzpah and publicity grabbing antics that Ryanair’s Michael O’Leary has used in Ireland and the UK.

The Norwegian carrier has expanded rapidly in recent years, and is seeking to challenge the dominance of Ryanair and easyJet in the European low-cost market. It has also become the latest low-cost airline to attempt to crack the long-haul market — a move which has seen some other carriers struggle or fail.

Norwegian on Thursday celebrates one year of flying from Gatwick to the US. It outlined plans to increase the frequency of its flights from Gatwick to New York to a daily connection from October.

Mr Kjos said Norwegian also plans to operate long-haul flights from Paris as early as next year. The airline is considering long-haul flights from Barcelona and Rome, although Mr Kjos admitted it does not yet have sufficient aircraft.

Norwegian has eight of Boeing’s Dreamliners and orders for a further nine of these passenger jets.

A spokeswoman for Norwegian said: “The reason for establishing a UK company is for access to bilateral traffic rights, enabling us to offer new destinations. However, if we do obtain ... permission for the UK air operating company it would allow us to be more flexible in our operation, with the use of our aircraft and crew.”

http://www.ft.com/cms/s/0/686fa236-2589-11e5-bd83-71cb60e8f08c.html#axzz3fOO4fMPQ